Financial Management

Streamline and automate your company’s financial processes and save time and costs

Benefits LIBRA Financial Management

LIBRA Financial Management is the module that has been designed to manage the financial processes of your company, both nationally and internationally. You will be able to gain precision and agility in your financial management, with real-time information and obtaining a global vision of your company. Thanks to LIBRA Financial Management companies will get multiple benefits such as:

Plan and obtain comprehensive control of your company’s financial management.

The Financial Management module supports the economic-financial management of the company, covering the areas of general accounting, analytical accounting, treasury management, asset management, cash management, budget management and financial scorecard.

LIBRA complies with international IFRS / IFRS standards, currently implemented in most of the most advanced countries. For this, LIBRA incorporates a double accounting criteria for the same accounting entry, which makes it easier to present the information under the national regulations of the country in question and under the criteria of IFRS standards.

The structure of the module allows a high level of flexibility when defining the tax structure of the company, facilitating implementation in international business groups. LIBRA has different grouping levels (accounting centers, balance sheet groups), on which it is possible to establish differentiated parameters at the accounting plan, work currency, tax scheme level.

General Accounting

Improve the quality and reliability of your financial data

- Accounting periods and analysis periods customizable by user.

- Fully programmable tax scheme in each country.

- Predefined accounting entries classified hierarchically.

- Multi-input and multi-tenant accounting entries, with automatic replication within the company or between companies.

- Automatic bank checking.

- Support with provision generation.

- Automatic verification for balance checking.

- Integration with public administrations, according to the regulations of each country.

- Leasing contracts.

- Adaptation to specific needs of business groups, facilitating mergers or corporate takeover.

- Support tools for balance sheets and results analysis.

- Reporting tools

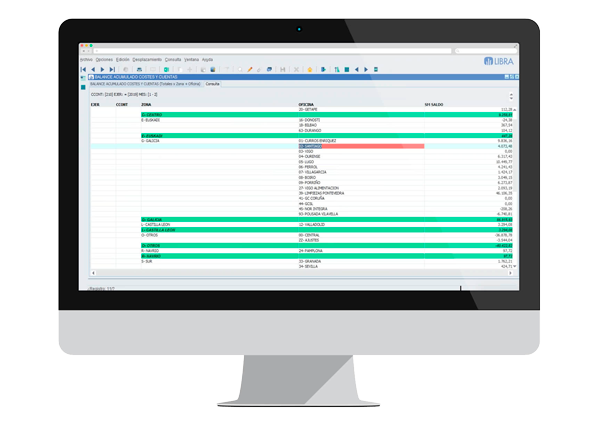

Analytical Accounting

Obtain accounting information for more informed decision making

- The structure of n-dimensional segments facilitates the management analysis from the perspective defined by administrators.

- Option to create relationships between analytical segments to automate data entry.

- Automatic or semi-automatic distribution criteria.

- Option to make cost distribution not only between segments but at the level of accounting centers, using allocation formulae variable in magnitude or percentage.

- Double analytical allocation.

- Centralized master data creation, such as accounts and analytical segments, enabling a maintained level of integrity in financial plans.

- Traceability to the data source in cost management through integration with other modules.

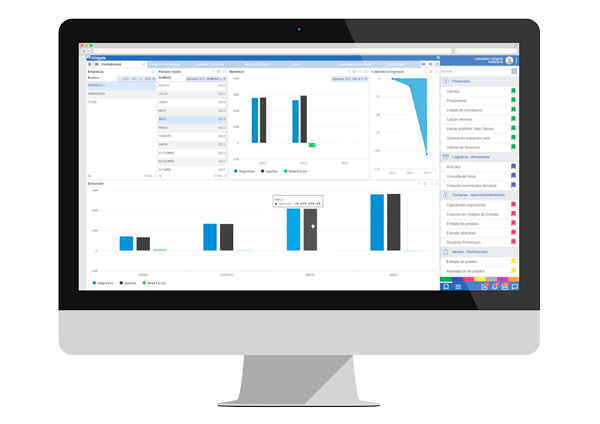

- Ability to generate reports and dashboards based on analytical information.

Treasury Management

Comprehensive planning and control of financial transactions

- Automated management of payments and collections.

- Cashpooling.

- Factoring and financing of payments.

- Credit insurance management.

- Management of completed and outstanding payments.

- Integration with electronic banking.

- EDI integration.

- Generation of cash management forecasts from sales and purchase orders.

- Maintenance of other provisions (wages, taxes, amortization of loans, …).

- Design of possible forecast scenarios and treasury predictions in each case.

- Definition of multiple registers, cash input and output management, supporting documents, integration with accounting and treasury, cash books.

- Cash reconstructions to date, to support accounting audit processes.

- Calculation of theoretical and actual collection and payment averages

Fixed Assets Management

Keep track of all depreciable assets

- Adaptation to IFRS international standards, maintaining the double required evaluation.

- Configurable asset data structure, with the option to assign particular characteristics.

- Hierarchical data levels for report generation.

- Location control.

- Option to establish a hierarchical structure of fixed assets.

- Different criteria for calculating quotas (linear, increasing digit, decreasing digit, …) and the possibility of carrying multiple amortization tables of the same element in parallel.

- Periodic amortization accounting.

- Audit and accounting check out.

- Amortization status control of each fixed asset element, set to any date.

- Historic record of each item.

- Integration with document management system module.

- Fixed assets analysis reports.

Budget Management

Automate your company’s budget calculations

- Templates for budgeting, with partial budgetary allocation, including an approval workflow.

- Unlimited number of budget studies. Users can create one from another (e.g. from previous budgets, actual data from past periods, etc.).

- Several data input modes; automatically, manually, or variable based on formulae.

- Budget definition based on management accounting.

- Budget definition based on ledger account and budget item; the amount and/or quantity.

- Analysis Tool for assessing deviations between budgeted and final expenditure amounts.

Financial Scorecard

Navigation from global ratios of the company, including accounting entries and documents

- Free choice of content and its structuring in rows and columns: groups of balance, accounting centers, headings, accounts, periods, etc.

- Option to define mathematical formulae for obtaining arithmetic results or ratios.

- Report output to screen and spreadsheet list, along with reading format or tabulated data for integration into pivot tables.

- Drill down navigation to accounting data source.

- Graphical capabilities.

Main functionalities of the Financial module:

- FINANCIAL MANAGEMENT

- GENERAL ACCOUNTING

- ANALYTICAL ACCOUNTING

- TREASURY

- FIXED ASSETS

- BUDGET MANAGEMENT

- CMF

- Adaptation to the needs of international groups: multicurrency, multiplan, audits, consolidation, etc.

- Integrated with the rest of the LIBRA modules.

- Bach data entry options available, to incorporate data from other systems such as banking or public administrations.

- Organization of data by entities, that is, customers, suppliers, banks and their banking products.

- The module allows you to generate any type of report, combining information from general, analytical, budget or treasury accounting.

- Accounting periods and analysis periods customizable by the user.

- Tax scheme fully parameterizable in each country.

- Predefined entries classified hierarchically.

- Multi-center and multi-company entry of seats, with automatic replication of the seats within the company or between companies.

- Automatic bank reconciliation.

- It helps the generation of provisions and their periodization.

- Automatic stippling that ensures accounting accounting processes.

- Telematic integration with public administrations, according to the regulations of each country.

- Management of leasing contracts. Adaptation to specific needs of business groups, facilitating business merger or absorption processes.

- Support tools for accounting closing processes and determination of results.

- Economic – financial reporting

- N-dimensional segment structure, which facilitates management analysis from the perspectives defined by management.

- Option to create relationships between analytical segments to automate data entry.

- Both manual and automatic or semi-automatic distribution formulas, which are responsible for distributing, without user intervention, the amount between the different analytical segments.

- Option to make distributions not only between segments but at the level of accounting centers using formulas for variable distribution in magnitude or percentage.

- Double analytical imputation.

- Option of centralized opening of entities, accounts and analytical segments, which allows maintaining a level of integrity in financial plans.

- Traceability to the original data in cost management, through integration with the rest of the modules.

- Possibility of generating reports and dashboards based on analytical information.

- Automated management of the collection and payment portfolio.

- Cashpooling.

- Collection effects endorsement.

- Factoring and financing.

- Credit insurance management.

- Management of collection and unpaid lists.

- Audit of portfolio portfolio of collections and payments with accounting.

- Integration with electronic banking.

- EDI in collections.

- Generation of estimates of collections and payments from sales and purchase orders.

- Maintenance of other forecasts (salaries, payment of taxes, amortization of loans, …) Design of possible scenarios and forecast of treasury in each one.

- Definition of multiple savings banks, management of entries and exits, supporting documents, integration with accounting and treasury, cash books, tonnage, etc.

- Treasury reconstructions to date, to support accounting auditing processes.

- Calculation of theoretical and real averages of collection and payment.

- Adaptation to international IFRS / IAS standards, maintaining the required double valuation.

- Parameterizable tab for the creation of fixed assets, with the option of defining particular characteristics for each one of them.

- Structuring of fixed assets by hierarchical levels for data exploitation.

- Location control.

- Option to establish a hierarchical structure of the fixed assets.

- Different criteria for calculating quotas (linear, increasing digit, decreasing digit …).

- Periodic accounting of amortizations.

- Audit and accounting balance.

- Situation of each item of fixed assets, at amortization level, at any date.

- Complete history of each element.

- Possibility of storing the documentation associated with each item of fixed assets with the LIBRA module of Document Management.

- Analysis reports on the management of fixed assets.

- Templates for the structured preparation of the company’s budget, with partial allocation to those responsible for budget units, including an approval workflow.

- Unlimited number of budget studies, being able to create some from others (for example, from previous budgets, real data from past periods, etc.).

- Entering the budget with distribution of the amount automatically, manually, variable or based on formulas.

- Budgetary definition at general or analytical accounting level.

- Definition by accounting account and budget item; by amount and / or quantity.

- Analysis tool for deviations between what was budgeted and what was finally executed (budget balance).

- Free choice of its contents and its structure in rows and columns: balance groups, accounting centers, epigraphs, accounts, periods, etc.

- Option to define mathematical formulas that make it possible to obtain arithmetic results or ratios.

- Output of the report to the screen, list and spreadsheet, either in reading format or with tabulated data for integration in dynamic tables.

- Option to consult the account statement that gives rise to the data, and from the extract, option to consult the documents that make up this note (invoice, order, etc.).

- Graphical output option through B.I Publisher, for the information generated through the CMF.

LIBRA ERP HAS 30 FULLY INTEGRATED MODULES THAT COVER ALL THE FUNCTIONALITY OF THE COMPANY

Fill out this short form to receive more information:

One of our experts will contact you as soon as possible.